Starlight Legacy Program –

A Legacy Gift to Your Church

Planned Giving is an easy way to give an offering by designating a gift to be given in the future – usually through a will or a trust. This method of giving allows you to establish a personal legacy with an eternal impact. Because of your generous contribution, future generations will be encouraged to stand on the authority of the Word of God and proclaim the good news of the gospel.

Most people, when given the opportunity, would like to feel that they have made a lasting contribution toward the cause for Christ, a better world, that their lives have touched others – perhaps for many generations to come. These gifts, made during the donor’s life or through one’s estate, strengthen the ability of your church to provide for future generations of members.

What is a Legacy (planned gift)?

It is a gift that generally does not become available to your church until some future date. It is a contribution committed through your will or trust to your church with the help of your financial advisor, Attorney, CPA, or other advisor.

How does a Legacy Gift benefit the donor?

It may allow the donor to make a significant gift beyond what he/she can give annually. It may minimize capital gains taxes. It may serve as a charitable income tax deduction. It may reduce estate taxes. It may provide income for life to the donor or other beneficiaries.

How does a Legacy Gift benefit the church?

It allows your church to increase its assets. It helps assure the future viability of your church by building an endowment. It encourages other individuals to consider making such a gift.

Where do I start?

Consult a professional financial advisor or an attorney, CPA or other advisor. Due to the complexities of rules relating to tax deductions for charitable giving, we recommend that you consult your advisor when considering a planned gift. Review simple estate planning strategies.

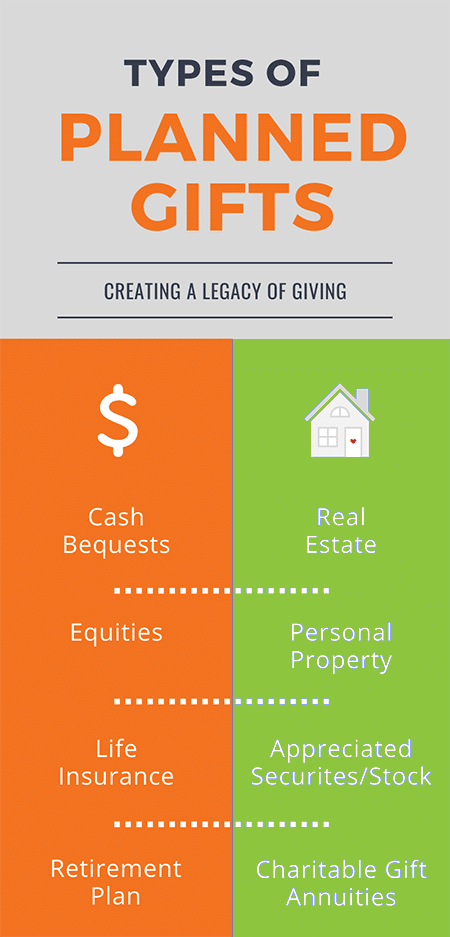

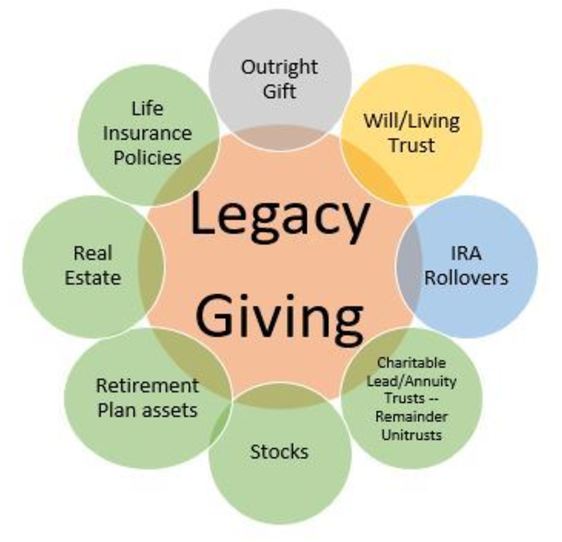

Decide what type of gift is right for you.